The End of SaaS Booming? Or a New Start?

Salesforce’s recent financial results have shown a significant slowdown in growth, with revenue and billings falling short of expectations.

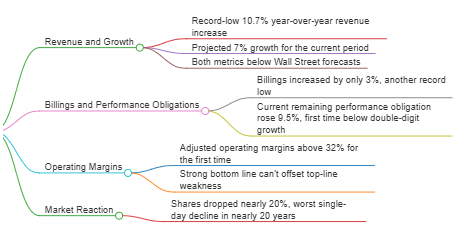

Salesforce reported a record-low 10.7% year-over-year revenue increase and projected just 7% growth for the current period. Billings grew by only 3%, another record low.

The adjusted operating margin is above 32%, for the first time. However the company’s shares dropped nearly 20%. The SaaS software sector is also facing challenges, with major deals taking longer to close and increased scrutiny on investments, particularly in AI. Many analysts suggest that AI investments are crowding out other enterprise software spending, raising concerns about the future monetization of AI for cloud software companies.

Source: https://www.wsj.com/tech/ai/salesforce-darkens-the-skies-for-cloud-software-as-ai-threat-looms

Questions

Q1: What was the main reason for the significant drop in Salesforce’s share price?

- A) Increased competition from Microsoft

- B) Record-low billings growth

- C) Disappointing financial results and forecasts

- D) High operating margins

Correct Answer: C

- Explanation: Salesforce’s shares dropped nearly 20% due to disappointing financial results and forecasts, which were below Wall Street’s expectations.

Q2: According to analysts, what is one of the reasons for the slowdown in enterprise software spending?

- A) Increased competition

- B) AI investments crowding out other spending

- C) Economic recession

- D) Regulatory changes

Correct Answer: B

- Explanation: Analysts suggest that AI investments are crowding out other enterprise software spending, contributing to the slowdown.